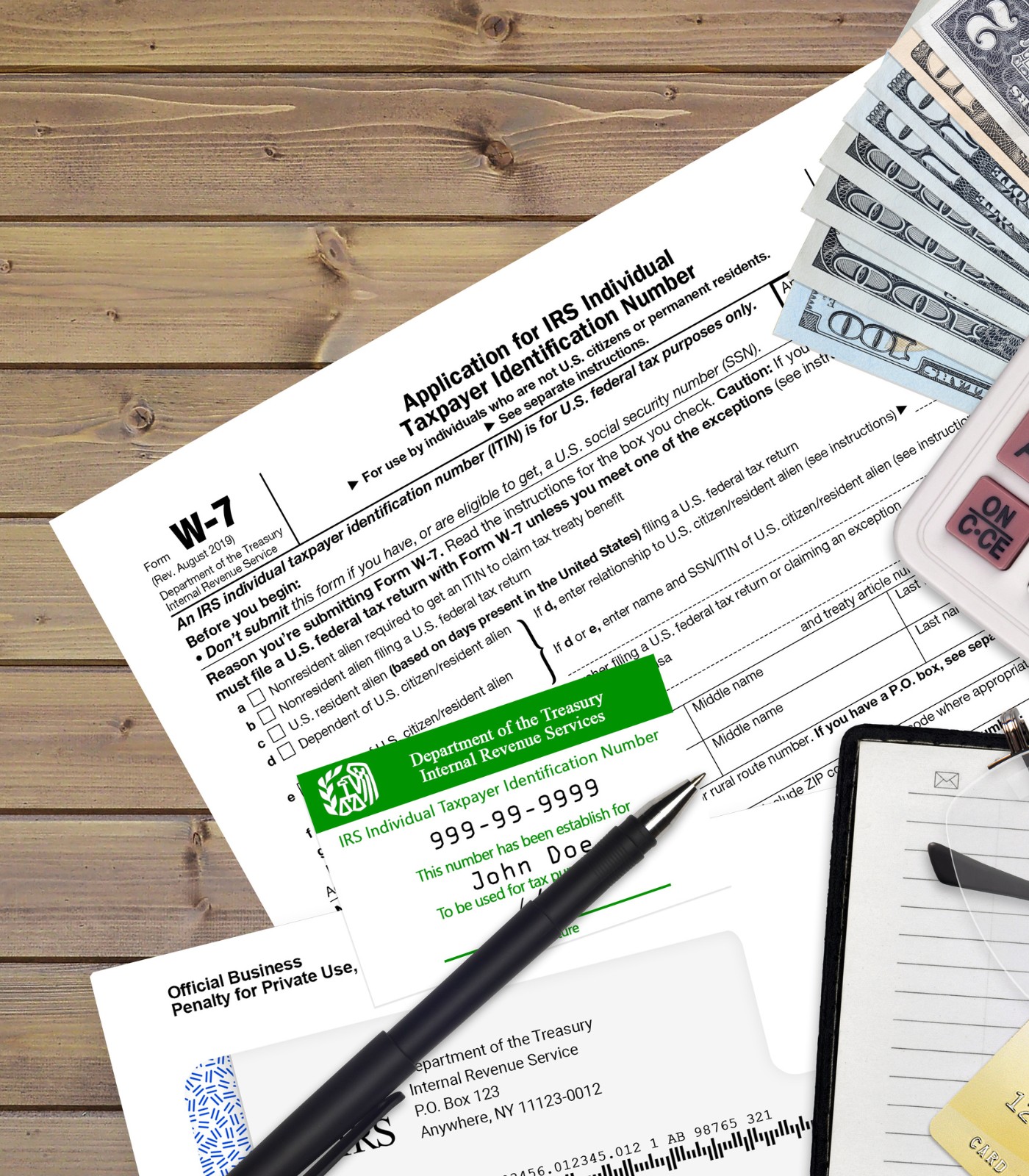

ITIN

ITIN

Common reasons to obtain an ITIN:

-

You own a business in the US and need to open a bank account, file US tax returns, etc.

-

You earn US-source income and must file US tax returns

-

You own U.S. property that is being sold and withholding tax is being taken

-

If you are a foreign partner in a U.S.-based partnership

-

If you have a foreign spouse or foreign dependents and would like to get the married filing jointly status or otherwise claim the dependents

Reasons to use a Certifying Acceptance Agent:

-

Without a CAA (Certifying Acceptance Agent), proof of identity and foreign status must be sent to the IRS – this means that you would be mailing your passport to the Austin, Texas IRS office. This may take weeks to process, and many feel uncomfortable with putting documents like this in the mail. As CAAs, we are on contract with the IRS to certify your identification documents ourselves, thus removing the need for you to send to the IRS.

-

We have a dedicated support line directly to the IRS, as well as a direct email contact with the ITIN office in Austin. An individual taxpayer does not have this and would have to correspond by mail, which would lengthen the process significantly if any issues arose in the ITIN process.

-

The final and main reason to use a CAA is you would have guidance throughout the ITIN process to make sure you are completing each item correctly. This type of support is not available through the IRS. We have served countless foreign-based clients and the accumulated experience brings unparalleled value.

For help with obtaining your ITIN, please feel free to contact us anytime, including weekends, at robert@igsss.com or at (718) 282-0829